A self-directed IRA is undoubtedly an exceptionally highly effective investment motor vehicle, but it really’s not for everybody. Because the stating goes: with fantastic energy will come terrific accountability; and having an SDIRA, that couldn’t be much more accurate. Continue reading to discover why an SDIRA could, or may not, be for yourself.

Larger Fees: SDIRAs normally include better administrative costs as compared to other IRAs, as specified aspects of the administrative process cannot be automated.

Confined Liquidity: A lot of the alternative assets that can be held in an SDIRA, including real estate property, non-public fairness, or precious metals, is probably not simply liquidated. This can be a concern if you have to accessibility resources rapidly.

Due Diligence: It really is called "self-directed" for any purpose. By having an SDIRA, that you are fully to blame for totally looking into and vetting investments.

When you’re seeking a ‘set and overlook’ investing strategy, an SDIRA probably isn’t the right decision. Simply because you are in whole Command above each individual investment manufactured, It is really your choice to perform your individual homework. Keep in mind, SDIRA custodians will not be fiduciaries and cannot make suggestions about investments.

Increased investment selections implies you may diversify your portfolio further than shares, bonds, and mutual funds and hedge your portfolio against marketplace fluctuations and volatility.

Feel your Good friend could possibly be starting off another Fb or Uber? By having an SDIRA, you could spend money on results in that you suspect in; and most likely love bigger returns.

Be accountable for the way you grow your retirement portfolio by utilizing your specialised understanding and interests to invest in assets that fit using your values. Obtained know-how in real-estate or non-public fairness? Use it to support your retirement planning.

Put just, when you’re trying to find a tax economical way to develop a portfolio that’s additional tailored towards your interests and expertise, an SDIRA can be the answer.

IRAs held at financial institutions and brokerage firms provide confined investment options for their customers as they don't have the knowledge or infrastructure to administer alternative assets.

Real-estate is among the preferred choices amid SDIRA holders. That’s for the reason that you can put money into any type of real estate which has a self-directed IRA.

Being an Trader, on the other hand, your options usually are not limited to stocks and bonds if you select to self-direct your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

The tax advantages are what make SDIRAs desirable For several. An SDIRA can be both of those common or Roth - the account type you choose will rely mostly on your investment and tax strategy. Check using your economical advisor or tax advisor for those who’re unsure and that is very best in your case.

Ease of Use and Technological innovation: A user-pleasant System with on the internet equipment to trace your investments, submit documents, and regulate your account is very important.

Have the freedom to click this speculate in Practically any sort of asset that has a possibility profile that matches your investment method; which include assets which have the opportunity for a higher fee of return.

Sometimes, the costs related to SDIRAs is often better plus more challenging than with an everyday IRA. This is because in the amplified complexity related to administering the account.

Of course, real estate property is among our consumers’ hottest investments, in some cases termed a property IRA. Clientele have the option to speculate in all the things from rental Attributes, industrial property, undeveloped land, property finance loan notes plus much more.

Complexity and Duty: Having an SDIRA, you have far more control over your investments, but Additionally you bear extra duty.

Whether you’re a economic advisor, investment issuer, or other monetary professional, check out how SDIRAs could become a robust asset to develop your organization and realize your Expert ambitions.

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Barry Watson Then & Now!

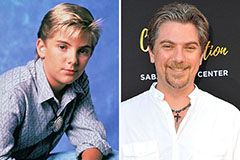

Barry Watson Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!